Mirror, mirror

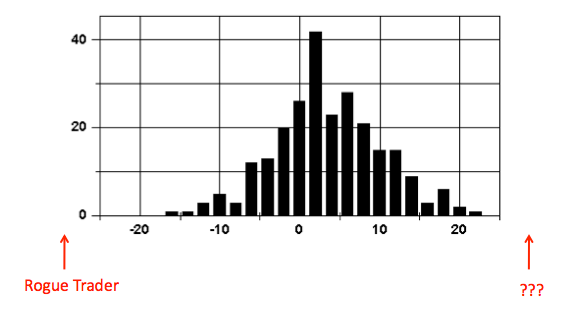

There has been a lot of self-righteous reporting in the business press regarding the "rogue trader" denting a bank's reputation, acting in "shady" ways, etc. The $2 billion lost in one trade would certainly qualify as an extreme event.

I invite readers to think about the entire spread of trade returns that a bank like UBS sees in any given period of time:

(I took the chart from this website, which illustrates the returns of using a particular trading strategy repeatedly. Whatever the strategies are used in aggregate by UBS traders, one should see a similar distribution, with a different average return and a different spread commensurate with the amount of aggregate risk taken by the traders.)

We call the negative outliers "rogue traders". What do we call the positive outliers?