Right metrics

Yesterday's post focused on the purely graphical aspects of NYT's very rich graphic on CEO compensation. Today, we take a look at the data being plotted. Aleks already jumped the gun, pointing out one deficiency of the stock price metric.

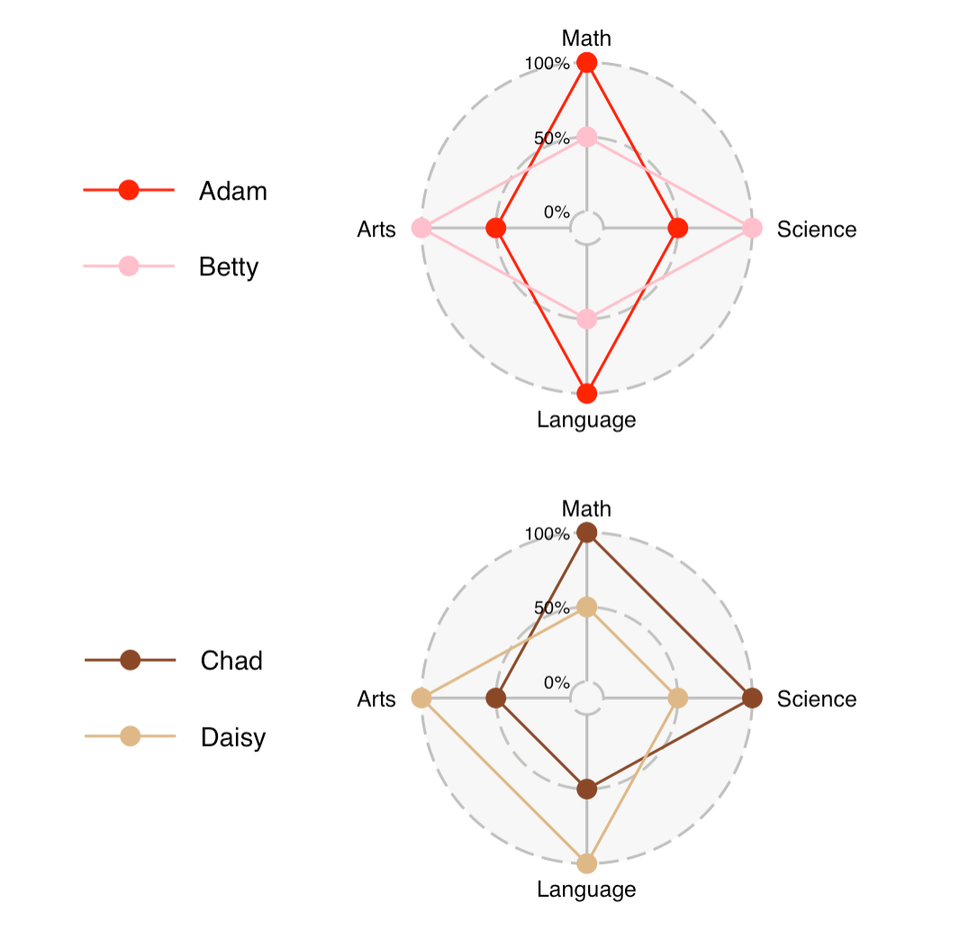

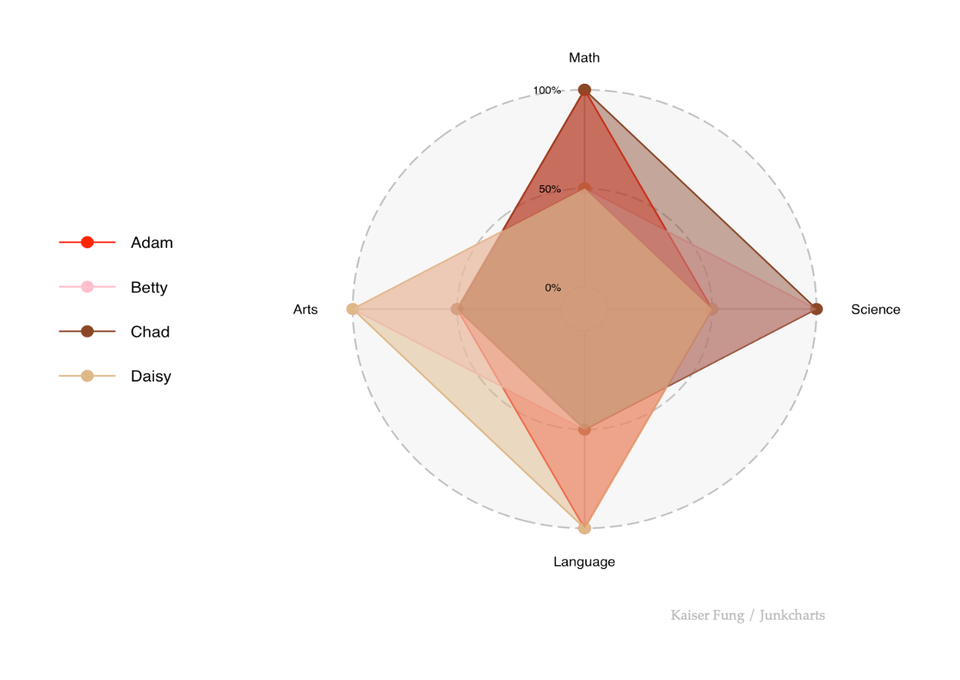

Recall the metrics were percent change of total CEO compensation (2006-2007), and percent change in company stock price (2006-2007).

The graphic attempted to simultaneously address two sets of comparisons: the relationship between compensation and stock price changes within one company; and the relationship of each company against "similarly sized" companies on compensation, and on stock price separately.

This graphic violates Godin's (Golden?) Rule #1, Only One Message, with which we generally agree. In trying to accommodate both comparisons, it managed to confuse readers. In particular, as pointed out yesterday, the primary comparison of compensation against stock price is hard to discern as the scale was determined by the second comparison (between companies).

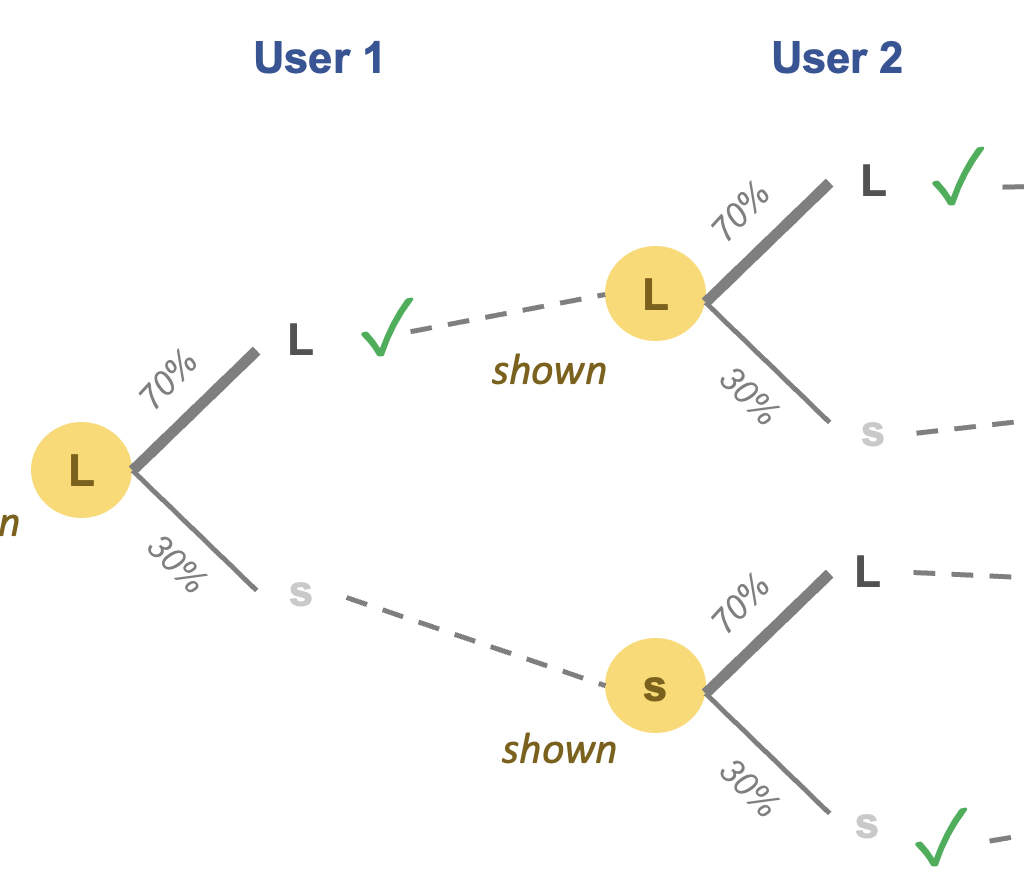

The issue Aleks pointed out is that some CEOs are paid by stock; thus, their compensation would rise and ebb as the stock price rises and ebbs. The correlation would then indicate the structure of the pay package, rather than the (presumed) pay for performance.

Stock price, in fact, is a poor indicator of company performance, especially short-term price changes such as the one-year changes used here. Further, we have a problem of mismatched timing: pay (excluding the stock component) moves much much more slowly than stock prices; besides, while stock prices experience positive and negative changes, pay changes are skewed positive! All these make direct comparison of these two metrics ill-advised.

If shareholder value is still the desired metric, then one should use a longer time-series. This will crowd out the comparison with similarly sized companies but make the graphic more useful.

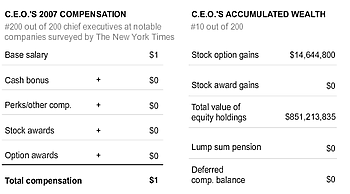

One final curiosity: according to this data set, Steve Jobs did charity work for Apple during that year; he received no stock or option grants and a nominal $1 salary. Is this real?