The largest gambling market in Europe, and the largest online

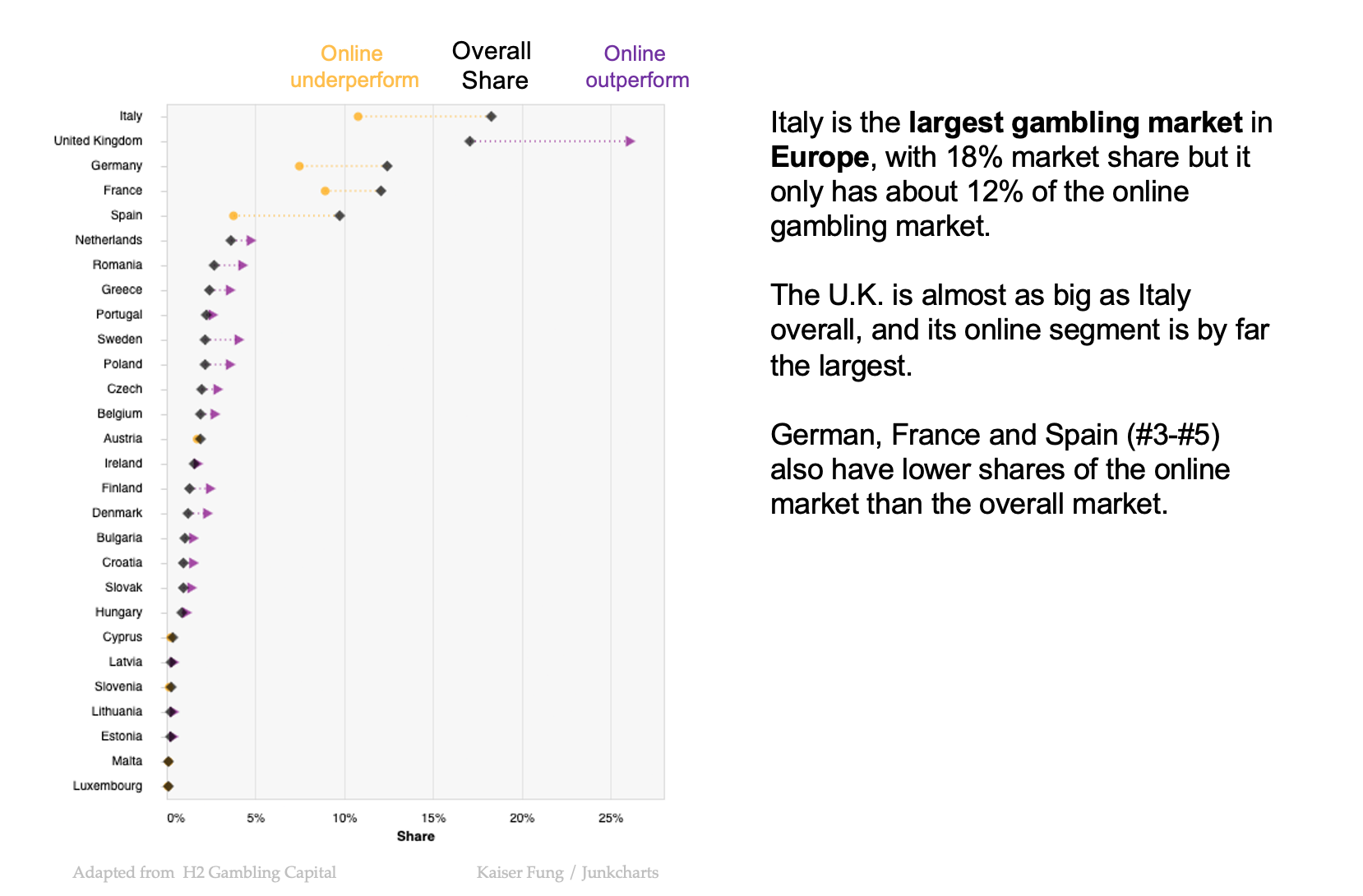

Kaiser re-imagines the chart about Europe's gambling revenues.

In a prior post, I discussed why the dual-axes chart about the European gambling market is mind-boggling.

Here is an alternative visualization that focuses on the story behind the dataset:

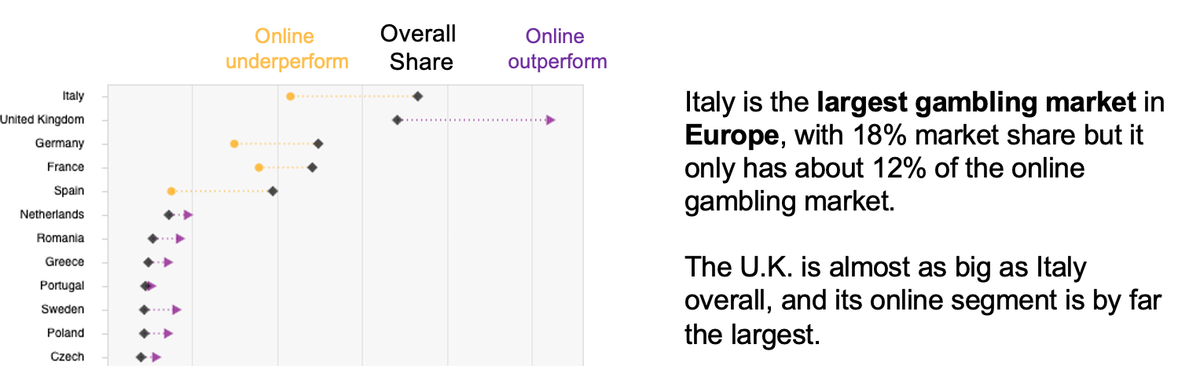

I'd like to center attention first to each country's share of gross gambling revenues. The top five are Italy, U.K., Germany, France and Spain, each accounting for 10-18% of the market. Everybody else is relatively insignificant, with less than 5% share.

The next important insight from the data is the over/under performance of the online sector compared to aggregate. I decided to use only the online data series because online better implies offline worse, and vice versa.

The countries are divided into two groups, those with online share higher than their aggregate share (shown in purple), and those with online share smaller than their aggregate share (shown in orange).

For example, Italy's overall share is about 1% but its online share is only 11%. By contrast, the U.K.'s overall share is 17% while its online share is 26%.

I'm using a different measure of online share from the designer of the original. On my chart, "online share" is each country's share of the aggregate European online gambling revenues. The total of these online shares sum to 100%. On the original chart, "online share" is defined as online's share of total gambling revenues within each country. The total of these online shares across countries is meaningless. The online share and offline share sum to 100% for each country.