Three reasons to doubt the GDP-gas price conjecture

Dragged by infectious incuriosity, the financial press ran with the story that falling gasoline prices (50% drop in 6 months) is "the best economic stimulus one can get". See former Deputy Treasury Secretary Robert Altman on CNBC, Business Insider's "cheap gas boost", Wall Street Journal citing the "low oil prices as an effective tax cut for consumers", New York Times quoting a Citigroup analyst claiming a global > $1 trillion stimulus, etc. etc.

This is the kind of story that one should believe only if half asleep. Here are three reasons why this conjecture is likely to be wrong:

1. Forgetting the big picture

There was a McDonalds next to a Burger King in a small town. The Burger King went out of business. The McDonalds suddenly did twice the usual business. Surely, McDonalds was the winner here but did the economy of the town expand? Unfortunately not. The consumers merely shifted their spend from Burger King to McDonalds.

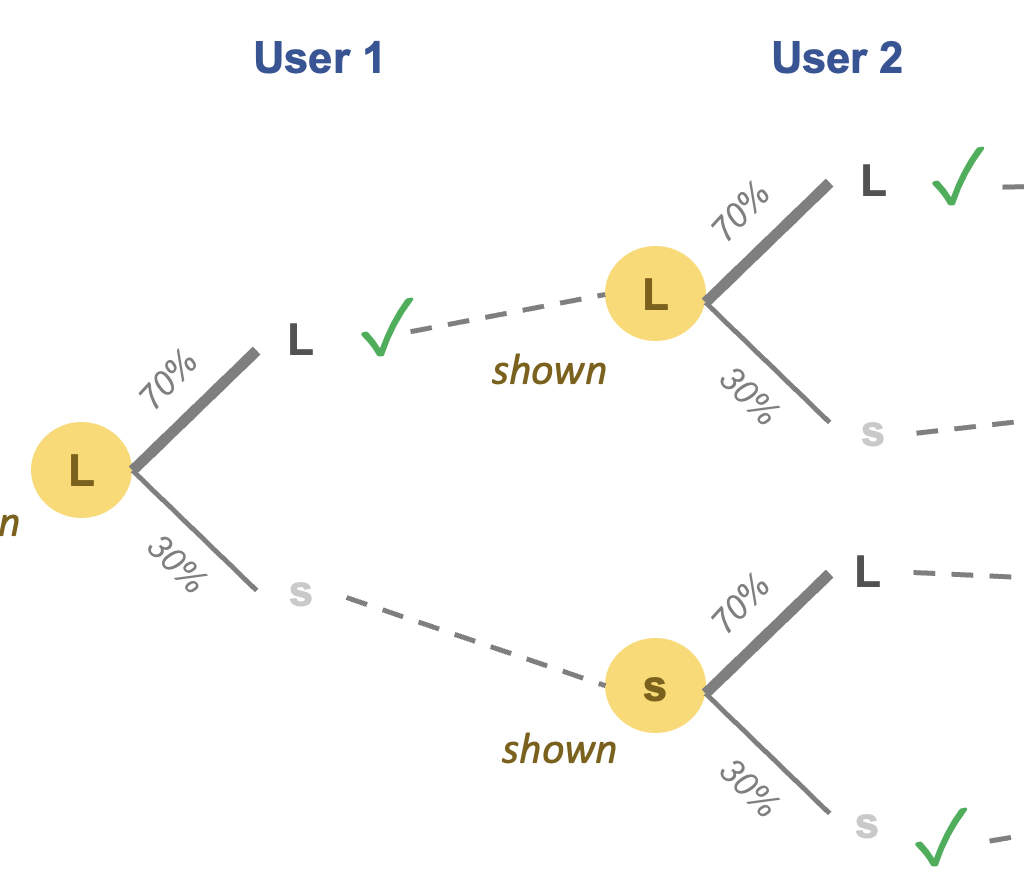

Now, consider a household that spends $200 a month on gas before the oil price crash. Let's say the same amount of gas now costs $100. According to those rosy-cheeked economists and journalists, the household now has an extra $100 to spend on other things, and this "extra" spending stimulates the economy.

But the total amount of expenditure is still $200. The only thing that changes here is the mix of spending. GDP is based on total spend, not the mix of spend. Some sectors of the economy will benefit but at the expense of the oil and gas sector.

2. Imperfect substitution

Consider our household again. The total economy size remains the same only if the household spends every dollar of the $100. If the household saves even one of those dollars, the economy shrinks, compared to before.

3. Making bad assumptions about the future

It's unclear from any of those articles how the analysts came up with the size of this oil-drop stimulus. Every one of them must make a forecast about future oil prices. I bet many of them take the current price as the new normal, and use that price as the future price.

If I tell you, you should not take an extreme value and treat it as the average, you'd scold me for stating the obvious.

As with most economic arguments, one could posit a much more complex chain of relationships that would argue how one goes from 50% drop in oil prices to trillions of economic stimulus. It is the business journalist's job to explain that complicated chain. The connection is clearly not as simple as reported. If one establishes a chain, such as A up ->B down ->C down -> D up, etc., each one of those causal links should be supported with evidence.

***

The same type of fallacious thinking pervades the business sector. For example, we keep hearing about the growth in retail sales from mobile devices. We don't know if consumers are shifting from the Web channel to the mobile channel, and how much of the mobile sales are incremental.